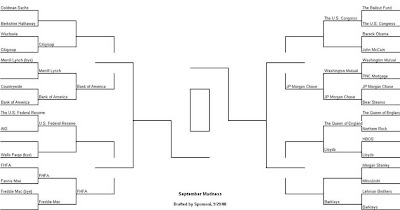

Click on the graphic to enlarge. Thanks to the reader who sent this in.

For example, look at the results for 2012. Under current law, the Bush tax cuts will expire, and the average marginal tax rate, calculated using my quadratic averaging, will be 28.7 percent. If the Bush tax cuts are extended, the average marginal tax rate will be 25.5 percent. The McCain plan would keep the average marginal tax rate at about this level (25.3 percent), while the Obama plan would raise the average marginal tax rate to 28.0 percent.

Overall, the Obama plan would leave average effective marginal tax rates virtually unchanged at 24 percent whereas the McCain plan would lower the average EMTR to 23 percent. But the impact of both proposals would differ greatly by income. At the upper end of the income distribution—for taxpayers with incomes of $1 million or more—the average EMTR under the Obama plan would rise from 34 to 40 percent but would not change under the McCain plan. At the very low end of the income scale—for those earning less than $10,000—the Obama plan would reduce average EMTRs dramatically from -4 to -11 percent whereas the McCain plan would again have no effect.One caveat:

Senator Obama has repeatedly suggested that he would increase taxes on high-income individuals as a way to extend the solvency of Social Security, but that any such increase would not take effect for years. When modeling the revenue and distributional implications of Senator Obama’s proposal as outlined by his economic advisers, the TPC did not include any change to payroll taxes or any form of income tax surcharge to pay for Social Security reform (and we do not include any in this paper either)....[However,] that proposal could raise effective tax rates on labor income for high earners to about 45 percent.A relevant question: What is the right way to take an average of various marginal tax rates? The deadweight loss of taxation rises roughly with the square of the tax rate. As a result, if one person sees the marginal tax rate fall from 20 to 15, while another sees it rise from 30 to 35, the average marginal tax rate is unchanged, but the deadweight loss increases. Perhaps the relevant average for thinking about deadweight loss is not the mean as conventionally computed but is, instead, the square root of the average squared tax rate. (The study by the Tax Policy Center does weight by earnings, which is appropriate to correct for cross-sectional heterogeneity in productivity, but this weighting does not deal with the fact that deadweight loss is roughly quadratic in the tax rate.) My guess is that under this "quadratic averaging," the average effective marginal tax rate would increase significantly under the Obama plan.